Rainbow Trail Forex Trading Strategy

Rainbow Trail Forex Trading Strategy

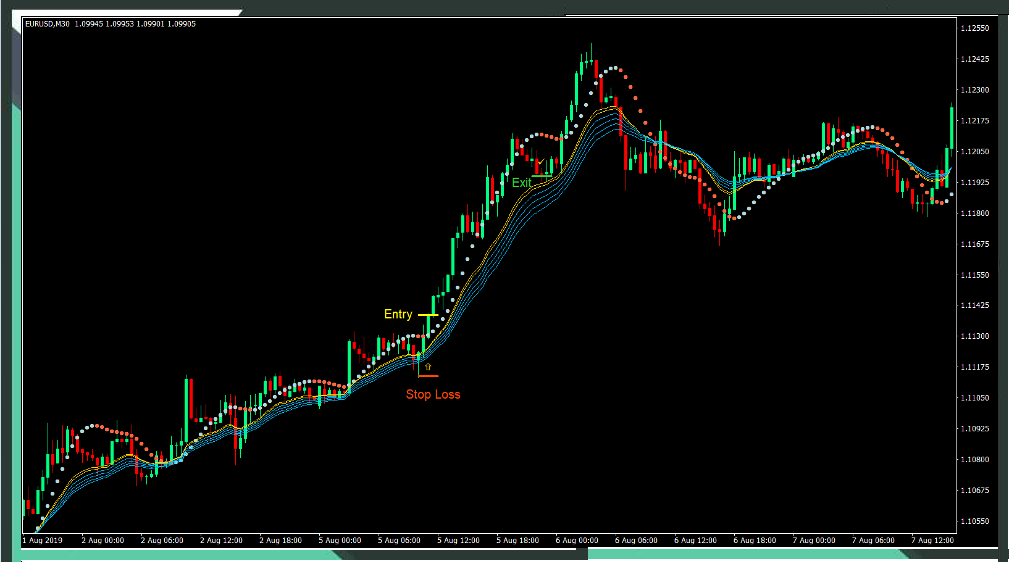

The Rainbow Trail Forex Trading Strategy is a trend continuation strategy that uses a technical indicator to identify potential trend continuation plays after a retracement. The indicator is based on a set of moving averages, which are used to identify potential plays after the price has moved towards the average price.

The strategy looks for when the price action crosses over a moving average line, or when a moving average line crosses over a slower moving average line. These signals are used to identify potential trend continuation plays.

The strategy can be used in any time frame, but it is best suited for use in the daily and weekly time frames. The strategy can be used with any currency pair.

The key to this strategy is to be patient and wait for the best trade setups. There is no need to force trades with this strategy.

The best trade setups will typically occur after the price has retraced and moved towards the moving average line. This is because the price is likely to continue in the direction of the trend after it has moved back towards the average price.

When trading with this strategy, it is important to use stop-loss orders to protect your capital. You can place your stop-loss orders below support levels or above resistance levels.

It is also a good idea to use take-profit orders when trading with this strategy. You can place your take-profit orders at previous highs or lows. Alternatively, you can use a trailing stop to lock in profits as the trade moves in your favor.

Rainbow MMA 09

Rainbow MAA 09 is a custom technical indicator that uses a set of modified moving averages. It plots eight lines, with two faster lines and six slower lines. The faster two lines are gold, and the slower six lines are deep sky blue.

This indicator can be used to identify the trend of the market.

The trend can be identified by looking at where the gold moving average lines are in relation to the deep sky-blue lines. If the gold lines are above the deep sky-blue lines, then the market is in an uptrend. If the gold lines are below the deep sky-blue lines, then the market is in a downtrend.

The trend strength can be based on the expansion and contraction of the moving average lines. If the lines are expanding, it means that the trend is getting stronger. If the lines are contracting, it might mean that the market is about to reverse or that it is already reversing.

HMA v2

The Rainbow Trail Forex Trading Strategy is a technical indicator that improves on standard moving average lines. Most types of moving averages have the same weakness: they are very lagging. This means that traders might not be able to respond to price action changes quite effectively if they are waiting on a lagging moving average line. Because of this, traders developed different types of Simple Moving Averages (SMA) to decrease the lag. These include the Exponential Weighted Moving Average (EMA) and the Linear Weighted Moving Average (LWMA). The Hull Moving Average (HMA) was also developed to try and get rid of the lag which plagues most moving average lines. The HMA is successful in decreasing lag significantly, but it also maintains a moving average line that is very responsive to price changes.

This version of the HMA plots dots instead of a line. These dots change color to indicate the direction of the trend. A light blue dot indicates a bullish short-term momentum, while a tomato dot indicates a bearish short-term momentum.

The Rainbow Trail Forex Trading Strategy can be used in any timeframe from the 1-hour chart up to the monthly chart. This makes it a very versatile tool that can be used by scalpers, day traders, and swing traders alike. The HMA has very little lag and is very responsive to price changes, which makes it a great tool for traders who want to get in and out of the market quickly.

The Rainbow Trail Forex Trading Strategy is a great tool for traders who want to get in and out of the market quickly. The HMA has very little lag and is very responsive to price changes, which makes it a great tool for traders who want to get in and out of the market quickly.

Trading Strategy

This is a trend-following strategy that uses moving averages to identify when the trend changes. The trend is first identified by looking at how the gold and dark sky-blue lines are stacked. The slope of the lines should also confirm the direction of the trend. Then, price action is looked at to see if it confirms the direction of the trend based on the pattern of its swing points.

We wait for the trend to establish and then look for price retracements. The retracements should cause the HMA v2 dots to temporarily reverse.

Trades are taken as soon as the HMA v2 dots resume the color of the main trend while aligned with a candle that confirms the direction of the trend.

Indicators:

Traders use indicators to help them make better trading decisions. These indicators can be applied to different time frames (30 minutes, 1 hour, and 4 hours) and currency pairs (FX majors, minors, and crosses). They are also used during the Tokyo, London, and New York trading sessions.

Buy Trade Setup

The Rainbow MMA 09 indicator lines should be above the deep blue lines, and the Rainbow MMA 09 lines should slope up.

Price action should create higher swing highs and swing lows.

Price should temporarily retrace causing the HMA v2 dots to temporarily reverse.

Enter a buy order as soon as the HMA v2 dots change to light blue while in confluence with a bullish candle

If the support level is below the entry candle, then set the stop loss there. When the HMA v2 dots turn tomato, close the trade.

Sell Trade Setup

The Rainbow MMA 09 indicator lines (gold and sky blue) should be below each other, and the Rainbow MMA 09 lines should slope down.

Price action should create lower swing highs and swing lows. Price will temporarily retrace, causing the HMA v2 dots to temporarily reverse.

Enter a sell order when the HMA v2 dots turn red and there is a bearish candle.

Stop Loss & Exit

- Set the stop-loss order on the resistance price above the entry candle.

- When the HMA v2 dots turn light blue, close the trade.

Conclusion

When trading in a trending market, it can be successful to trade when the price moves back towards an area of strong support or resistance. If used in the right market, this trend continuation strategy can produce profits over and over as long as the trend continues. However, traders should be careful not to trade this strategy in a choppy market or in a trend that does not fit the timeframe.

Some trends are too steep on shorter timeframes, while others could retrace too deep on other timeframes. To find the right timeframe to use, scan through different timeframes and see where the price is respecting the Rainbow MMA 09 lines as a dynamic support or resistance. Once you find the right trend in the right timeframe, you can start using this trend continuation strategy effectively.

When trading with the Rainbow Trail Forex Trading Strategy, traders should look for a currency pair that is trending on a longer timeframe and then use a shorter timeframe to find entries. For example, if you are looking at the EUR/USD pair on a daily timeframe and you see that it is in an uptrend, you could then switch to a 4-hour timeframe to find entries.

To do this, traders would look for the price to retrace back towards the Rainbow MMA 09 lines on the 4-hour chart and then enter a buy order when the price starts to move back up. Traders would then place their stop loss below the most recent low and their target profit at a previous high or Fibonacci level.

This strategy can be used in any trending market and on any timeframe. However, traders should be careful not to trade this strategy in a choppy market or in a trend that does not fit the timeframe.