Simplified Fibonacci Trading Strategy and Tools You Need

Simplified Fibonacci Trading Strategy and Tools You Need

Fibonacci is a number sequence that can help you make money. Many professional traders use it to make a lot of money. Some people even have cars like BMWs, Ferraris, and Porsches because they used Fibonacci to make money.

So, here’s a very simple way to use this information. When the market starts going up again after a temporary decrease, that’s called a retracement. Retracements are normal in markets and they usually don’t last very long.

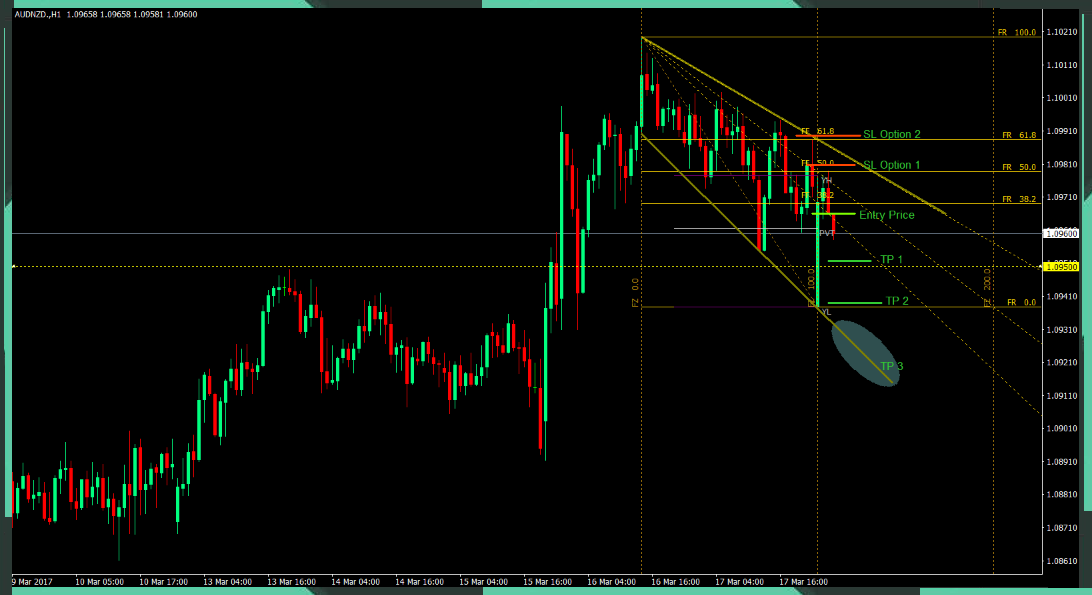

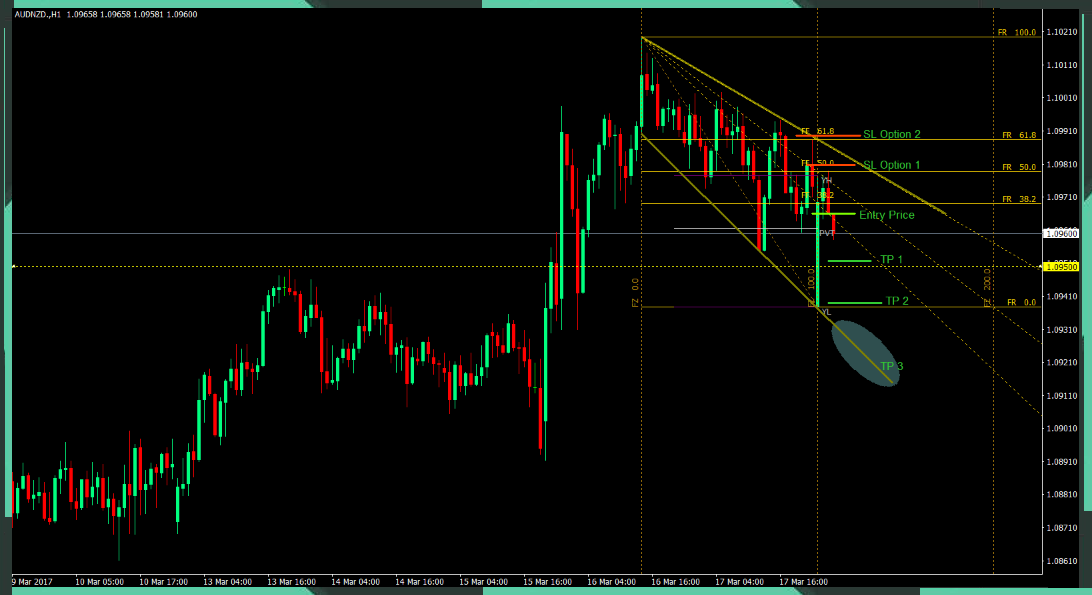

Here is an example of how to spot retracements in a downtrend:

The first thing you need to do is find the most recent highpoint and the most recent lowpoint.

The price for this forex pair is starting to go down. However, it’s not going down steadily. It’s going up and then down again before continuing to go down. This is happening because the people who sold this pair are now getting rid of them at a higher price, so the prices are going up before they go back down again.

The Fibonacci Retracements tool is used to identify areas of support and resistance on a price chart. It is based on the idea that markets will retrace a certain percentage of the original move, after which the market will continue in the original direction. The retracement levels are calculated using the Fibonacci sequence.

The Fibonacci Retracements tool can be used to find areas of support and resistance on a price chart. To do this, you first need to identify the major high and low points on the chart. You then calculate the Fibonacci levels between these two points. The 23.6%, 38.2%, and 61.8% levels are support levels, while the 50% and 100% levels are resistance levels.

If the market is in a downtrend, you would look for selling opportunities when the price retraces to one of these support levels. If the market is in an uptrend, you would look for buying opportunities when the price retraces to one of these resistance levels.

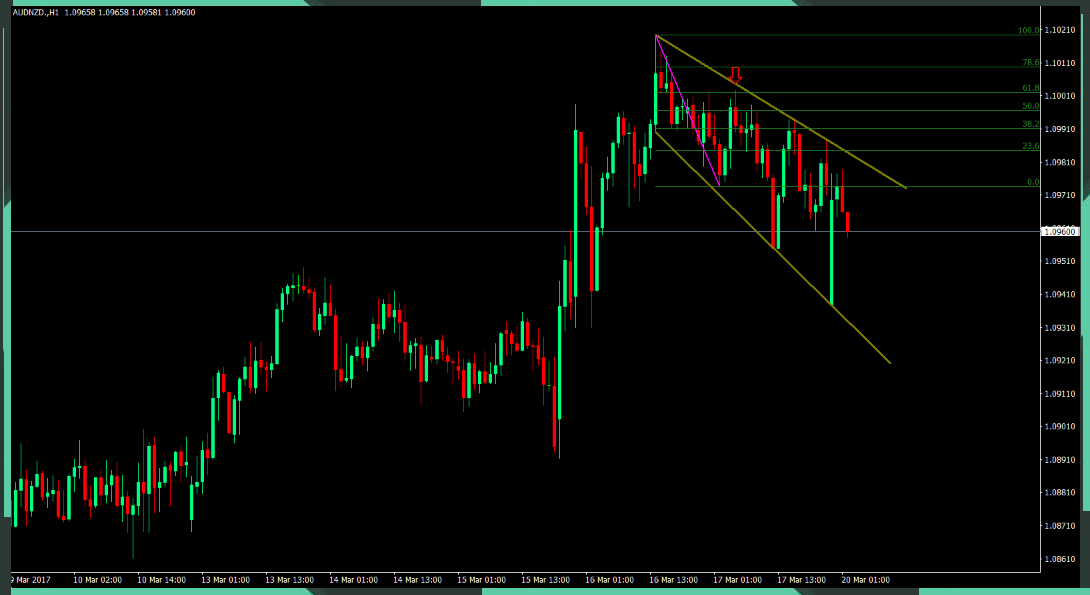

Exhibit 2 shows that the price retraced to 61.8% of the Fibonacci sequence before continuing downwards.

As you can see from Exhibit 3.

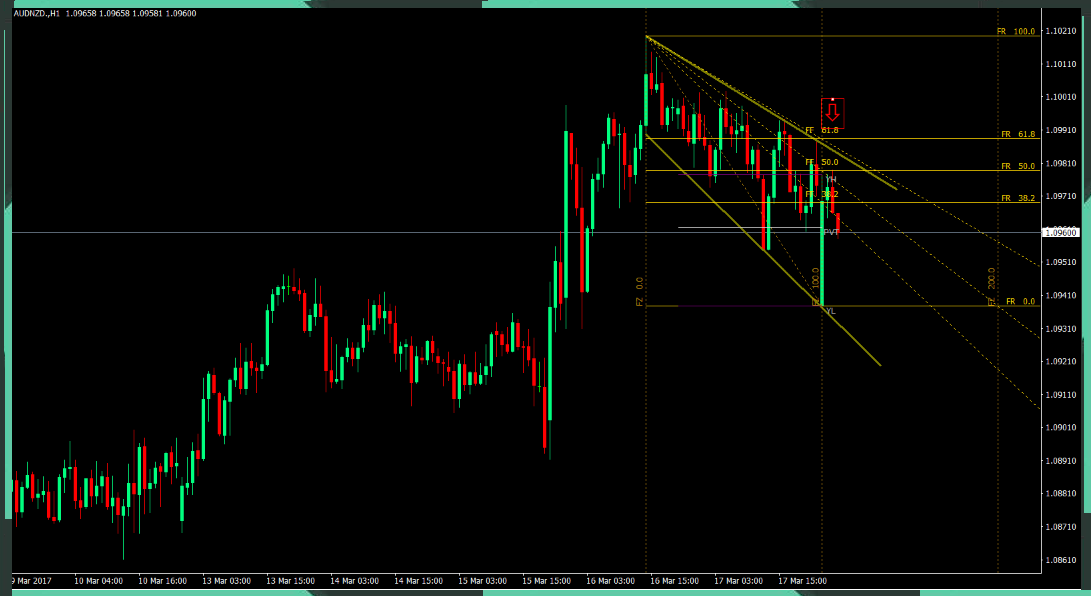

Yes, we can use Fibonacci Retracement tools to predict where a price might stop, reverse, and continue its path down. And yes, we can use the standard Fibonacci Retracement tool from MT4. However, for people who are not experts, the Fibonacci Retracement tool is very subjective. Plus, the fact that we are trading on the right edge of the chart, meaning we don’t know what is going to happen next, makes it much harder.

There is a solution to every problem. Even if things don’t seem to be going your way, there is always a way to fix it. In this case, we have an indicator that automatically plots the Fibonacci Retracement ruler, even though no retracement has been completed yet. This removes the subjectivity of plotting it on the chart.

The Entry

Rule 1: Don’t trade before the candle closes. This means that you shouldn’t enter a trade until the candle has finished. Sometimes people make the mistake of trading even before the candle has closed. This can be risky because there are times when the candle reverses right before it finishes. If this happens, you would lose money on your trade.

Rule 2: Enter on the next open candle. This means that if you wait for the signal candle to close, then you trade on the open of the entry candle.

Rule 3: Before you do a trade, think about the risk-reward ratio. This means thinking about how much you could lose compared to how much you could earn. If the signal candle is very long, it might not be worth it to enter the trade because you could lose more pips than you would gain.

Stop Loss

There are two options for Stop Loss. The first option is to put it just above the signal candle. This has the advantage of making it easier to make money because you are risking a smaller number of pips. However, there is a higher chance that your Stop Loss will get hit before the price goes in your desired direction.

The second option is to put the Stop Loss just beyond the previous fib level. This is a safer choice because it is far from the price. However, this option has a disadvantage: you will have a smaller position since you will be risking more pips.

Target Price

I think partial take profits are a good idea because it means I have already made some money from the trade, and it also allows me to make a bit more money if the trade goes my way.

Where would I put my take profits in this trade?

Target Price 1 would be just before the numbers that have no decimal places? But first, what are numbers without decimal places? Numbers without decimal places are prices with whole increments. Traditionally speaking, whole numbers are increments of 100 pips. So, it could be 109.00, 110.00, 111.00, and so on. Why are these important? Because institutional position traders think that way. They don’t mind the nuisance of the small pips, but take positions depending on what they project prices would be months down the line.

If they have pending buy orders at those levels, the price could go back up if they fill. But I’m going to do something a bit different. I’m going to sell for 50 pips because things have changed and we need to think ahead of other traders. This will be half of my position. Once the price hits that level, I’ll close half my position. Also, I’ll move my Stop Loss to a positive Stop Loss so I don’t lose money.

Target Price 2 is just before the previous lowest low (or highest high for an uptrend). This is because the price previously went back up from there and there might still be some more pending buy orders that were not filled that could take prices back up. Here, I will close 25% of my position, leaving the last 25% as a Hail Mary throw to the finish line.

Target Price 3 will be on the diagonal trendline. Many traders trade based on the trendline and they might reverse the trade once the trendline is hit. So, when the trendline is hit, I’ll close my position.

Conclusion

Fibonacci is a helpful tool for making money in forex. Many successful professional and retail traders use it. You should use it too because it works even though no one knows why. As long as you use it wisely with the correct money management, you could make a lot of money with this tool.